…

12 August 2018

..

Tamys 譚應祥 @tamys46 5 hours ago

Hiding from the rakyat?? @BNM_official @guanenglim @LiewChinTong @malaymail @billtay25.

…

Liability on Unauthorised Credit Card Charges – SKRINE – Law Firm …

SKRINE is one of the largest law firms in Malaysia providing a comprehensive range of legal services to a large cross-section of the business community in …

| Liability on Unauthorised Credit Card Charges |

| After a day of intense retail therapy, you suddenly realise that you had left your credit card in one of the shops at the mall several hours ago. You experience heart palpitations at the thought of being charged astronomical sums for unauthorised or fraudulent transactions. What should you do?

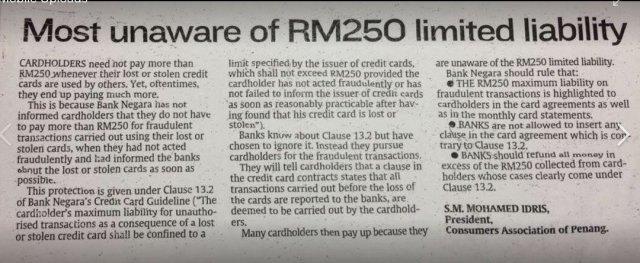

The answer is simple. Report the loss of your credit card to your credit card issuer without any delay. Clause 15.2 of Bank Negara’s Credit Card Guidelines (BNM/RH/GL-041-01)(the “Guidelines”) provides that the cardholder’s maximum liability for unauthorised transactions as a consequence of a lost or stolen credit card shall be limited to the specified by the issuer of credit cards, which shall not exceed RM250, provided the cardholder has not acted fraudulently or has not failed to inform the issuer of credit cards as soon as reasonably practicable after having found that his credit card is lost or stolen. The efficacy of Clause 15.2 was tested in Diana Chee Vun Hsai v Citibank Berhad [2009] 6 CLJ 774. In this case, the cardholder reported the loss of her credit card to the issuer of her credit card on the day that she discovered its loss. The card issuer claimed a sum of RM1,859.01 from the cardholder as unauthorised charges incurred on her credit card. The card issuer relied on a provision in the credit card agreement which stated that the RM250 limit only applied to transactions effected within one hour prior to the reporting of the loss of the credit card. The High Court ruled in favour of the cardholder and held that the Guidelines are subsidiary legislation and have the force of law. The Court also found that the credit card agreement must be construed in accordance with the Payment Systems Act 2003 and the card issuer could not circumvent the Guidelines in order to limit its liability. Accordingly, the Court held that the provision in the credit card agreement relied on by the card issuer to limit the application of the RM250 liability was “unreasonable, ridiculous and contrary to Clause 15.2 of the Guidelines”. The Court also held that the onus lay on the card issuer to prove that there had been unreasonable delay by the cardholder to report the loss of the card and that it had failed to produce any evidence to discharge this burden. Hence, if you report the loss without delay, like Ms Chee did, you should be able to limit your loss to RM250 if the unauthorised charges exceed that amount. Writer’s e-mail: loshini.ramarmuty@skrine.com |

http://www.skrine.com/liability-on-unauthorised-credit-card-charges

…

Excerpts from:

Those Bloody Banks, Credit Card Companies and Bank Negara!

A consideration of the recent High Court decision of Diana Chee Vun Hsai v Citibank Bhd [2009] 6 CLJ 774 about whether the Bank Negara Guidelines BNM/RH/GLO-041-01 (with regards to credit cards) has the force of law and whether banks are limited to only claiming RM 250.00 for unauthorized transactions when you lose your credit card. Kalvathy Maruthavanar’s paper ‘Internet Banking – A boon or a bane? A study on the legal issues relating to internet banking in Malaysia’ is also considered.

Diana Chee Vun Hsai, like many of us owned a credit card. She had two. One from Citibank Berhad, the other from HSBC Bank Berhad. On 7 September 2008, HSBC called up her to alert her about her credit card being used. When she checked her purse, she discovered both her credit cards were missing. She notified both the credit card companies of the loss of her credit cards on the same day and lodged a police report at Dang Wangi police station about it the following day. She understandably thought that was the end of the matter. She was wrong.

On 16 September 2008, Citibank told Diana Chee Vun Hsai they were billing her for the unauthorized transaction of RM 1,859.01 done on 6 September 2008. She responded through her solicitors to inform Citibank that the limit of liability for a lost credit card was RM 250.00 as provided in clauses 15.1, 15.2 and 15.3 of the Bank Negara Guidelines BNM/RH/GLO-041-01 (‘the BNM Guidelines’). Citibank’s lawyers replied pointing out to her that the terms of her credit card the crux of which is as follows:

“Our client imposes a duty on the cardholder to notify the loss one (1) hour prior to the unauthorized use and to provide proof of acting in good faith and exercising reasonable care and diligence to prevent such loss or theft of unauthorized use of the card before our client can exercise its discretion whether to resolve the liability or not. Such a clause is not in contravention of the Bank Negara guidelines.”(emphasis mine)

.

Diana Chee rightly did not agree with the absurd reply and sued Citibank for several declarations the main ones being (i) that the BNM Guidelines issued pursuant to sections 25 and 70 the Payment Systems Act 2003 have the force of law and (ii) the term relied upon by Citibank to deduct the sum of RM 1,859.01 was illegal, void and contrary to public policy.

Justice Mohd Apandi Ali who heard the case at the outset opined that Citibank was an operator under the Payment Systems Act 2003 and therefore bound by the BNM Guidelines, which his Lordship very helpfully reproduces in its entirety for our benefit. I would strongly recommend those with credit cards to read and understand it. This would prevent credit card companies from taking advantage of your ignorance and fear of seeking legal advice. Clause 15.2 of the BNM Guidelines was referred to and is worth considering in full:

15. Liability For Lost Or Stolen Credit Card

15.2 The cardholders’ maximum liability for unauthorized transactions as a consequence of a lost or stolen credit card shall be confined to a limit specified by the issuer of the credit cards, which shall not exceed RM 250.00, provided the cardholder has not acted fraudulently or has not failed to inform the issuer of credit card as soon as reasonably practicable after having found that his credit card is lost or stolen.

His Lordship then opined quite rightly, ‘This “one hour prior to reporting of the loss card” clause, to my mind is not only unreasonable and ridiculous but it is contrary to the provisions of cl. 15.2 of the Bank Negara Guidelines. In fact, the RM 250 is the maximum liability of the cardholder in such circumstances, and that the onus of proving fraud or unreasonable delay to report loss of the card is upon the issuer of the credit card.‘ So in this case, the Judge ruled that it was Citibank that had to prove any alleged fraud or unreasonable delay on the part of Diana Chee before they can deny her the limitation of liability.

This is my favourite part:

“The cardholder has complied with the said terms of reporting and confirming the loss of the credit card. The respondent cannot have the discretion, despite having it so written in the agreement, to circumvent the Bank Negara guidelines, with a view to limit its liability.“

There you have it. Citibank despite knowing the BNM Guidelines defiantly made terms of agreements for their credit cards that not only infringed the BNM Guidelines but was designed with the purpose of limiting its own liability. This you can appreciate could translate into increased profits for them.

The Judge then rightly goes on to point out that breaching the BNM Guidelines is an offence punishable under section 57 of the Payment Systems Act 2003 which prescribes a fine not exceeding RM 500,000.00. If the credit card company continues to offend it then it will be additionally liable to a fine not exceeding RM 1,000.00 for everyday that the offence continues. His Lordship states that, ‘the issuer of the credit card is also liable to have its approval revoked by Bank Negara if the issuer has failed to comply with any of the Guidelines issued by Bank Negara.’ So clearly, the BNM Guidelines is an offence and if your credit card of bank is in breach of it, you should lodge a complaint with Bank Negara.

…

Another piece of good news. It feels like Christmas again and we have been having so many in 2018 post 09may. So, Merry Christmas everyone.

Who,read,the,f,p,only,lut,sees,and,a,

Pingback: Avoiding Debit/Credit Card Fraud, and what to do if it happens to you… | weehingthong