…

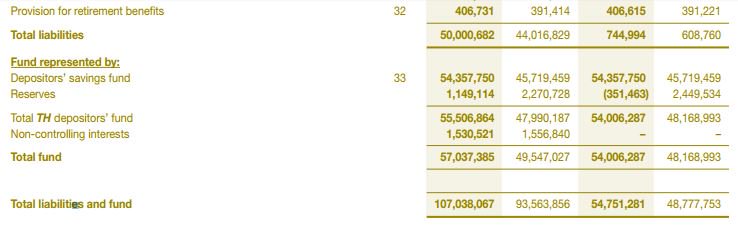

Umno Baling MP and Tabung Haji Chairman, Datuk Seri Abdul Azeez…

Tabung Haji, 1MDB and the Tun Razak Exchange (TRX) land deal.

…

TABUNG HAJI HAS 8.8 MILLION DEPOSITORS

…

10 December 2018

..

..

..

The 2017 Auditor-General’s (A-G) Report last week revealed that TH failed to record an asset impairment of RM227.81 million in three subsidiary companies and three associate companies, especially its investment in associate company TH Heavy Engineering Bhd amounting to RM164.58 million.

The A-G added that TH’s policy on reporting the impairment of assets was inconsistent.

..

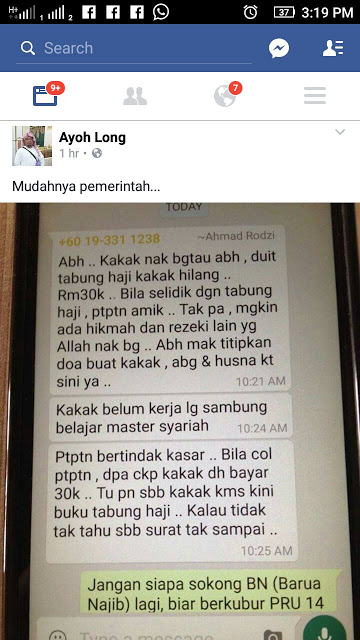

KUALA LUMPUR: Minister in the Prime Minister’s Department Mujahid Yusof Rawa says pilgrims fund Tabung Haji (TH) has been paying dividends to its depositors despite bearing liabilities that are significantly higher than its assets.

Speaking in a press conference at Parliament today, the minister in charge of Islamic affairs said TH recorded assets of RM7.3 billion up till December 2017, but liabilities of RM74.4 billion.

“This is the point I want to make: TH has been paying off dividends, or ‘hibah’ to its depositors despite bearing a much higher liability.

“The decision also contravenes the TH Act itself where it says TH can only pay dividends to depositors when it is making money or has a higher number of assets.”

After Pakatan Harapan took over the government and appointed a new management team, he said, top audit firm PricewaterhouseCoopers (PwC) was hired to re-evaluate TH’s financial position for 2017.

He said the auditors discovered that TH had been paying dividends despite its high liabilities since 2014.

The Parit Buntar MP also said the government had given approval for the management team, led by TH’s group managing director and CEO Zukri Samat to start a comprehensive turnaround plan in a bid to close the gap between TH’s assets and liabilities.

“We have set up a special purpose vehicle to manage TH’s current financial situation and try to maximise the use of TH’s under-performing assets,” he said, adding that TH would be placed under the supervision of Bank Negara Malaysa beginning Jan 1 next year.

“We want to restore our depositors’ confidence in TH,” he said.

…

9 December 2018

KUALA LUMPUR – Tabung Haji (TH) has yet to receive the full payment of US$910 million (RM3.8 billion) from the sale of its 95 per cent stake in Indonesian company PT TH Indo Plantations (THIP) to PT Borneo Pacific in 2012.

The Edge today quoting sources reported that TH obtained “far less” than what it should have from PT Borneo — an unlisted company controlled by Indonesian businessman Alexander Thaslim at the time — even after giving discounts.

On November 30, TH lodged two police reports against its former chairman Datuk Seri Abdul Azeez Abdul Rahim, former chief executive officer, Tan Sri Ismee Ismail and Datuk Seri Johan Abdullah as well as four other senior management personnel alleging misconduct on their part pertaining to TH’s financial affairs.

The senior staff were Datuk Adi Azuan (Chief Operating Officer) and Datuk Rozaida Omar (Chief Financial Officer), Hazlina Mohd Khalid (Legal Adviser) and Rifina Md Ariff (Senior General Manager, Corporate Services and Real Estate).

“Despite the extensions, the rest of the purchase price were not paid,” The Edge Malaysia said after it sighted a copy of the police report.

It said TH also claimed that Ismee had recommended that the TH board transfer all of THIP’s shares to a nominee of PT Borneo, PT Nusa Prima Energi during a board meeting on February 10, 2014.

“Ismee, Rifina and Hazlina were alleged to not have disclose that doing so would relinquish TH’s rights over THIP’s shares and the shares were subsequently transferred.

“This caused TH Indopalms Sdn Bhd and TH Indo Industries Sdn Bhd — to suffer losses “amounting to the earnest deposit of US$18.2 million (RM75.8 million),” it said.

In the police report, TH also claimed it had paid a redemption sum to Maybank Islamic Bhd after TH said its board was notified by Ismee that TH would have to ratify the advance of US$178.6 million (RM 744 million) given to THIP for the redemption on behalf of PT Borneo.

“Legally and under the CSPA, PT Borneo should be the one paying the sum under a financial agreement dated March 25, 2011 and there was no prior approval by TH for the advance.

“There was concealment of material information in which failure by PT Borneo to redeem would have been tantamount to material breach of the CSPA, subsequently entitling TH to terminate the agreement,” it said.

The final allegation was that TH claimed there was false representation of a deadline payment after Ismee had told TH that the payment of US$81.8 million (RM 34.1 million) could be paid on March 31, 2013 when it was contractually due on December 14, 2012.

“The CSPA obliged PT Borneo to pay the sum on Dec 14, the failure of which would entitle TH to forfeit the earnest deposit of US$18.2 million (RM75.8 million).

“Separately on April 9, 2014, Ismee had stated that a sum of US$280 million (RM1.2 billion) had been paid to THIP when there was no confirmation such sum was received,” it said.

https://www.malaysia-chronicle.com/?p=146795

…

..

..

..

..

https://twitter.com/esshankar1/status/1068788689755561994

..

..

..

…

13 April 2016

…

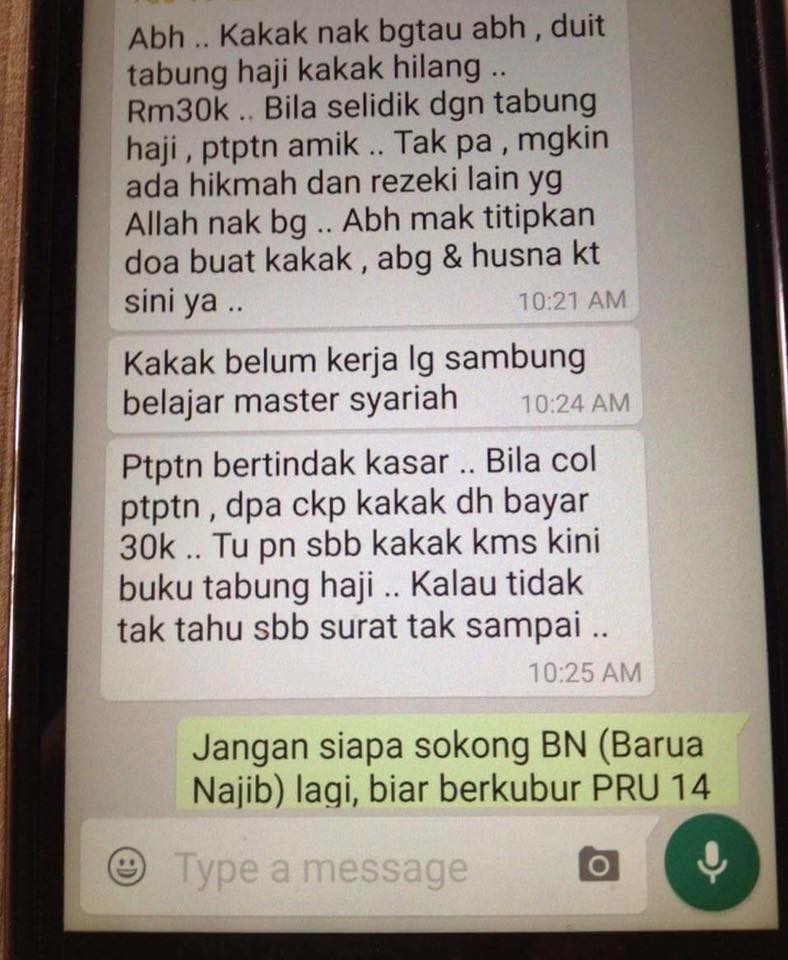

Tabung Haji, PTPTN sahkan perkara ini tidak berlaku. Individu terlibat mohon maaf. #AWANI745 @501Awani

.

—

Malay Mail Online @themmailonline

Tabung Haji denies taking money from student’s account to pay PTPTN loan

KUALA LUMPUR, April 12 — Lembaga Tabung Haji (TH) has refuted claims on social media of its involvement in the debiting of money from a depositor’s account to repay National Higher Education Fund (PTPTN) loans, saying they are baseless.

“TH does not have any joint venture related to the payment of PTPTN loans. Any withdrawal from depositors’ accounts needs to have the agreement of the depositors themselves,” the pilgrimage fund said in a statement today.

However, it said, the party involved in the matter has apologised to TH by letter and through social media.

…

“All account withdrawals or transfers regardless from banks or TH accounts can only be performed upon instructions from the account holder.” #AWANINews

...

PTPTN has no access to borrowers’ private accounts, including Tabung Haji – Chairman

http://ds-media.blogspot.com/2016/04/ptptn-boleh-ambil-duit-dalam-akaun.html

—

28 Feb 2016

malaysiakini.com @malaysiakini

TH lodges police report against Rafizi over RM963m guarantee claim

Lembaga Tabung Haji (TH) has lodged a police report against PKR vice-president Rafizi Ramli for alleging that the fund had made almost RM1 billion in corporate guarantees to troubled associate company TH Heavy Engineering Bhd (THHE).

The alleged guarantee is significant as Rafizi claimed a leak risk assessment by TH’s management department warned that the fund risks losing up to RM1.4 billion if THHE fails to deliver on its obligations.

Rafizi had on Friday released a Finance Ministry letter which revealed TH received approval for the corporate guarantee after the fund denied the allegation.

However, TH today reiterated its denial that it never provided any corporate guarantee to THHE.

The fund also challenged Rafizi to name the bank involved if it had really provided a corporate guarantee to THHE.

“Tabung Haji regrets the arbitrary circulation of documents (about the corporate guarantee) on social media and baseless accusations which are defamatory.

‘”The claims impacted Tabung Haji negatively and affects the interest of its depositors.

“Therefore, Tabung Haji lodged a polie report against the Pandan MP over his allegations and the documents he circulated,” it said.

It said the move was to safeguard Tabung Haji’s reputation as an Islamic institution as well as its depositors.

https://www.malaysiakini.com/news/332021

—

25 Feb 2016

Tabung Haji risks RM1.4b loss with continued investment in troubled O&G firm, says @rafiziramli http://bit.ly/1Letvc3

PETALING JAYA, Feb 25 — Lembaga Tabung Haji risks losing at least RM1.4 billion if it continues its commitment to invest in troubled oil-and-gas company TH Heavy Engineering Berhad (THHE), PKR’s Rafizi Ramli claimed today.

Rafizi said that THHE, which was formerly known as Ramunia Holdings Bhd was already facing heavy financial losses and was suspended from Bursa Malaysia back in 2010 when it slipped into Practice Note 17 (PN17) status.

“Tabung Haji then increased its investments in Ramunia Holdings Berhad which was rebranded as TH Heavy Engineering Berhad (THHE), and appointed a representative as CEO and remains as the biggest shareholder,” Rafizi told a news conference here.

Based on THHE’s latest risk assessment report, he said that LTH’s management had given the company a corporate guarantee late last year despite its financial troubles.

“The investment risks in Tabung Haji is now at least RM1.4 billion (total share losses amounting to RM100 million, injecting RM275 million via a Islamic irredeemable convertible preference (ICPS-I) exercise, RM50 million sukuk and corporate guarantee of RM981 million,” Rafizi said, citing figures obtained from the risks assessment report.

“My main question is how much more will Tabung Haji inject in THHE to last for another five to eight years when the price of crude oil has dropped, when it failed to revive THHE in previous years when the price of crude oil was at its peak?” the Pandan MP asked.

—

23 Feb 2016

Tabung Haji lost nearly RM100 million in Silverbird shares, says Rafizi http://bit.ly/1L82cQC

Published: 23 February 2016 3:37 PM

PKR’s Rafizi Ramli today alleged that Lembaga Tabung Haji’s aggressive move to invest in a bread-making company in 2007 has landed the fund with losses of nearly RM100 million.

Rafizi, the party secretary-general, said Tabung Haji’s active buying of Silverbird Group Berhad’s (now known as Hi-5 Conglomerate Berhad) shares was prevalent between September and October 2007, which saw the soaring of the bread-making company’s shares from 39 sen (early Sept 2007) to RM1.08 on Oct 16, 2007.

“Tabung Haji later emerged as the largest shareholder at the end of financial year that ended October 31, 2007,” he said, adding that the pilgrims’ fund invested about RM98 million for 90.483 million shares, or 28.81% in the company.

Rafizi questioned if due diligence was done because when Tabung Haji exited the investment in 2014, the share prices had dropped to between a RM0.07 and RM0.08 per share.

At the moment, he said Hi-5 Conglomerate Berhad’s share is priced at RM0.04 per share.

“The company ran into trouble (after 2007) and Tabung Haji lost the investment, but held on (the investment) until the middle of 2014 before selling it off,”

“This in a way gives you an idea that if Tabung Haji had done its due diligence, it would have been more careful because the due diligence will have highlighted the possibility of this. Clearly this was not done.”

He said the de-listing of Silverbird from Bursa Malaysia in 2011 was due to several incidents including the Criminal Breach of Trust (CBT) charge against its top management.

—

Malay Mail Omline

Quit and political attacks will end, Tabung Haji chairman told

KUALA LUMPUR, Feb 22 — PKR’s Rafizi Ramli told Baling MP Datuk Seri Azeez Abdul Rahim today to give up his position as Lembaga Tabung Haji (LTH) chairman if he could not deal with the flurry of questions on the financial status of the Muslim pilgrims’ fund.

The opposition lawmaker said his Umno counterpart has had a dubious run to date in his public explanations concerning the board’s investment decisions and reiterated his previous call for a non-politician to helm LTH.

“Till now, he has not presented figures to deny my allegations apart from reiterating that they mere slander.

“That is why if he does not want Tabung Haji to be a political focus, it is best there is no political interference in Tabung Haji,” Rafizi said in a statement in response to Azeez’s reported remark yesterday.

State newswire Bernama reported Azeez saying the criticisms over LTH’s purported poor financial health were politically motivated in an attempt to turn the fund’s depositors against him.

“If want to attack me, attack me politically but don’t involve Tabung Haji without making checks… stop it,” he was quoted telling reporters after a programme in Baling, Kedah yesterday.

– See more at: http://www.themalaymailonline.com/malaysia/article/quit-and-political-attacks-will-end-tabung-haji-chairman-told#sthash.fIaOZCOu.dpuf

—

Tabung Haji lost nearly RM1b from Felda Global Ventures investment, @rafiziramli claims http://bit.ly/1KT9PdM

Tabung Haji lost nearly RM1b from Felda Global Ventures investment, PKR MP claims

KUALA LUMPUR, Feb 16 ― Lembaga Tabung Haji (LTH) has lost RM933 million from the Muslim pilgrimage fund’s investment in Felda Global Ventures (FGV) whose shares have been plunging, PKR lawmaker Rafizi Ramli alleged today.

The PKR secretary-general said LTH had paid RM1.3 billion to purchase shares from the plantation giant, but added the shares are currently only worth RM454 million since FGV was listed in 2012.

Rafizi also said LTH only made a profit of RM7.6 million when it sold FGV shares in 2012, with the last major transaction on July 12, 2012, of a sale of 750,000 shares.

“This means that even though FGV shares have been plunging, Tabung Haji didn’t take any action to protect depositors’ funds of RM1.3 billion that were invested in FGV,” Rafizi told a press conference here.

The federal opposition MP said although others may dismiss the RM933 million as a “paper loss,” it was important as it would affect LTH’s asset valuation.

“The loss of RM933 million is a big indicator of Tabung Haji’s finances,” said Rafizi.

The Pandan MP claimed it was a “political” decision for LTH not to sell off the FGV shares, pointing out that other government fund managers like the Employees Provident Fund (EPF) and the Retirement Fund Incorporated (KWAP) have been trying to cut their losses in FGV by reducing their shares from 2012 to 2015.

—

Tabung Haji calls for end to allegations over financial position

Lembaga Tabung Haji has called for an end to the baseless allegations being levelled against it, which have stirred up confusion and impacted unity among Muslims.

In a statement today, Tabung Haji said its financial position was strong with a revenue of RM4.47 billion and realised profit reaching RM3.53 billion for the financial year 2015.

“From 2009 to this year, Tabung Haji has retained RM9,980 as the haj fee for each pilgrim. For 2016, the actual haj cost rose to RM18,890, so the subsidy is RM8,910 for each.

“Tabung Haji is expected to bear a subsidy of RM160 million for this haj season.

“The clearly strong financial and investment position of Tabung Haji has enabled it to bear the haj subsidy of RM815 million over the past decade.”

—

#AWANInews Tabung Haji announces annual bonus of 5 percent for its 8.85 mil depositors http://english.astroawani.com/business-news/tabung-haji-announces-annual-bonus-5-percent-its-8-85-mil-depositors-92796 …

KUALA LUMPUR: Tabung Haji (TH) today announce an annual bonus payment of 5 percent to 8.85 million depositors for the financial year 2015.

In addition, an extra 3 percent bonus also given to depositors who have not perform the pilgrimage, thus making the overall bonus of 8 percent.

—

30 January 2016

AS LONG AS DEPOSITORS DON’T RUSH TO WITHDRAW THEIR DEPOSITS, TABUNG HAJI WILL BE ALRIGHT

Malaysian Insider

KUALA LUMPUR, Jan 30 — Lembaga Tabung Haji (LTH) is not in danger of insolvency as long as depositors are not spooked into en masse withdrawals of their savings with the pilgrims fund, according to a local economist.

Questions about the fund’s financial standing were raised after a leaked letter showed Bank Negara Malaysia telling Tabung Haji last December 23 that its liabilities had exceeded its assets by a ratio of RM1 to 98 sen, a situation which means it is legally barred from issuing dividends and bonuses to its depositors.

“As long as everybody doesn’t try to withdraw all at once, Tabung Haji should be okay,” the unnamed economist attached to a local asset management fund was quoted saying by The Edge in its latest weekly paper.

The economist added that LTH’s asset shortfall was not worrying as it was a result of it paying out disproportionately high dividends to its depositors.

But the same economist quoted by The Edge questioned why Tabung Haji continued to pay high dividends when it was not supported by a similar increase in income growth.

“The point of having reserves is to smooth out fluctuations in returns from year to year. So, save in a good year, run it down in a bad year. But it seems like they have been running it down even in the good years,” the economist said.

According to Tabung Haji’s annual report cited by The Edge, the fund paid RM2.46 billion bonuses to depositors at a rate of eight per cent in 2012 despite a net profit of RM2.15 billion; in 2013, it paid RM2.632 billion in bonuses from a net profit of RM2.634 billion.

The fund again overpaid in 2014, issuing RM3.24 billion in depositor bonuses with only RM2.98 billion in net profits, or a rate of 8.25 per cent that is the highest since 1998, The Edge said.

—

27 January 2016

…

malaysiakini.com @malaysiakini

Action to be taken on TH staff who leaked BNM letter

Action will be taken against the Lembaga Tabung Haji (TH) staff who leaked the Bank Negara Malaysia cautionary letter to the pilgrimage fund, TH chairperson Abdul Azeez Abdul Rahim said.

He said he had discussed this with TH’s lawyer and the fund would press charges if necessary, he told Bernama.

https://www.malaysiakini.com/news/328491

—

Kadir sees something ‘abnormal’ at Tabung Haji http://www.freemalaysiatoday.com/category/nation/2016/01/27/kadir-sees-something-abnormal-at-tabung-haji/ …

Free Malaysia Today

Kadir sees something ‘abnormal’ at Tabung Haji

Apandi Ali’s appointment to the Tabung Haji board suggests there could have been a criminal act which, if not properly managed, could end up in court.

KUALA LUMPUR: With the “events” on Tuesday, said a veteran newsman, Attorney-General Mohd Apandi Ali has elevated himself to the status of troubleshooter extraordinaire for the Prime Minister in just over half a year, a meteoric rise indeed.

“As for the extraordinary appointment of Apandi to the board of Tabung Haji, the timing could not have been less inauspicious,” said A Kadir Jasin in his latest blog posting.

He said it confirmed the suspicion that something abnormal was happening at the pilgrims fund. “His appointment suggests that there could have been a criminal act which, if not properly managed, could end up in court.”

Likewise, the Court of Justice may not have the chance to prove or disprove Prime Minister Najib Abdul Razak’s culpability, he added. “He may be safe from prosecution for now. But despite the AG closing the case, the court of public opinion will continue to try him.

—

AG’s Tabung Haji appointment not a reward for closing PM’s case, chair says http://buff.ly/23s4Iat

KUALA LUMPUR, Jan 27 — Lembaga Tabung Haji (LTH) has denied claims that Tan Sri Mohamed Apandi Ali’s board appointment in the Muslim pilgrimage fund was due to the Attorney-General closing two cases involving more than RM2 billion channeled to Prime Minister Datuk Seri Najib Razak.

LTH chairman Datuk Seri Abdul Azeez Abdul Rahim told news portal BNBBC News that the opposition would have used anyone else’s appointment as LTH director to smear the fund’s image, pointing out that his own appointment was similarly maligned.

“People outside will keep talking bad about me, for example, if I were to appoint another lawyer instead like Tan Sri Shafee Abdullah.People will say that he’s a crony,” Azeez was quoted saying, referring to the prominent Umno lawyer.

“I have good intentions in wanting to safeguard our depositors and fellow Muslims by placing legal practitioners in TH,” he added.

—

IS THIS LETTER GENUINE OR FRAUDULENT?

—

26 January 2016

…

Star

26 January 2016 | MYT 6:17 PM

Tabung Haji assures it has money to pay bonus

PETALING JAYA: Lembaga Tabung Haji (LTH) has assured its 8.8 million depositors that it has money to pay bonuses which will be announced by March.

Group managing director Tan Sri Ismee Ismail said the board, at its present financial situation “is stable and supported by assets.”

Acknowledging that there were speculations revolving around the date of the bonus announcement, Ismee said:

“We would like to reinstate that the announcement and bonus payments will be done in the first quarter of the year, like it was done previously, and we would like to reassure that there will be no delay this time around.

“However, before the announcement is made, LTH will need to consider the economic climate at that time and ensure that the auditing process gets approved internally for proper management,” Ismee said in a statement.

…

Ismee stressed that depositors need not worry as their savings was guaranteed by the government under the Tabung Haji Act.

Referring to the letter by Bank Negara on LTH’s lower asset value compared to liabilities, Ismee said the central bank was recommending that the board reviews its reserve policy in view of the economic situation and stock market downturn.

“As a government-linked institution, LTH will always work with all parties to ensure that all risk management measures are followed, and therefore we will consider the recommendation by Bank Negara.

“We need to take into account the overall fair value of the investment portfolio.This is because the value of the assets declared do not include the investment portfolio such as stock of subsidiaries or associated companies as well as plantation and property assets occupied by LTH,” he said.

He added that the total asset value of LTH throughout 2014 and 2015 was far higher than its liabilities and therefore depositors should be careful with information spread on social media.

…

Referring to the letter by Bank Negara on LTH’s lower asset value compared to liabilities, Ismee said the central bank was recommending that the board reviews its reserve policy in view of the economic situation and stock market downturn.

“As a government-linked institution, LTH will always work with all parties to ensure that all risk management measures are followed, and therefore we will consider the recommendation by Bank Negara.

…

He added that the total asset value of LTH throughout 2014 and 2015 was far higher than its liabilities and therefore depositors should be careful with information spread on social media.

—

Bank Negara sent ‘risk management’ advisory to Tabung Haji

Bank Negara send ‘risk management’ advisory to @TabungHaji https://www.malaysiakini.com/news/328303

…

Bank Negara said that it had sent advisory notices to Lembaga Tabung Haji on its risk management practices but said that the pilgrimage fund has taken corrective measures and is headed towards “a sustainable and healthy financial position”.

“In relation to Lembaga Tabung Haji, the institution has proactively taken appropriate measures to further strengthen its risk management practices, both on its own initiative and in response to earlier engagements with the bank,” the central bank said in a statement today.

“These will reinforce a sustainable and healthy financial position of the institution, going forward,” added Bank Negara.

However, the statement did not mention nor confirm or deny if the images of letters circulated online recently, purported to be from the central bank to the pilgrimage fund, were genuine or in any way linked to Bank Negara’s stated “engagement” with Tabung Haji over its “risk management practice”.

The leaked documents purportedly detailed the central bank’s alleged advisory to Tabung Haji over its slipping reserves and the declining value of its investments.

https://www.malaysiakini.com/news/328303

—

Tabung Haji chairman denies reserves in the red http://bit.ly/1ZPenmO

…

…

When asked to confirm whether Tabung Haji’s reserves were in the red, Azeez said: “No. It’s not true.”

Datuk Asyraf Wajdi Dusuki, deputy minister in charge of Islamic affairs, said Malaysians were taking out of context the Bank Negara letters warning Tabung Haji’s reserves were in the negative.

He said the letter was being used to trigger accusations that Tabung Haji was suffering from losses and would be unable to pay out dividends to its nearly 9 million contributors.

Asyraf did not deny this but urged Malaysians to evaluate the information carefully and remember that the letters did not provide the full picture of the fund’s financial situation.

—

Tabung Haji reserves not below zero, board chairman insists

KUALA LUMPUR, Jan 26 ― Lembaga Tabung Haji (LTH) chairman Datuk Abdul Azeez Abdul Rahim denied today news reports that reserves in the Muslim pilgrims’ fund was in the negative, but kept mum on other allegations concerning the state of its finances.

“No. It’s not true,” he replied reporters outside the Dewan Rakyat here when asked about LTH’s negative reserves.

He declined to comment further when asked about the fund’s financial health, saying the board will hold a separate news conference later to respond to claims it can’t pay dividends to its 8.8 million Muslim depositors this year.

—

Tabung Haji‘s reserves halved on group-level, negative on company-level in 2014 even as liabilities grew

—

and Tabung Haji chairman Abdul Azeez thinks the BNM letter may not be genuine

—

Tabung Haji Insolvent — Zeti Warns PM That Fund’s Mismanagement Threatens A Billion Ringgit Bail Out EXCLUSIVE!

Sarawak Report has received an explosive series of documents relating to the emerging Tabung Haji financial crisis, including two stark letters of warning from the Governor of the Bank of Malaysia indicating that the fund is on the brink of collapse and a massive bail out by taxpayers.

The near identical three page letters, both dated 23rd December 2015, were sent to the Chairman of the fund, Abdul Azeez Abdul Rahim and to a minister in the Prime Minister’s Department, Jamil Baharom, copied to the Prime Minister/Finance Minister, Najib Razak.

In the two letters the BNM Governor, Zeti Akhtar Aziz, warned that the Tabung Haji fund now risks failing in its primary purpose:

“the worrying financial situation at Lembaga Tabung Haji… will make it difficult in the future for the LTH to play an effective role in helping Muslim pilgrims to perform their Haj” [translation]

She goes on to warn that the fund’s obligations far exceed its assets and that the vast majority of the income invested in the fund is controlled by a small number of institutional investors, who might easily pull out if they cease to receive adequate returns, leaving the majority of small investors (would be pilgrims) high and dry.

Presumably in an effort to keep those lenders (5% of depositors are understood to control 75% of the funds) the banking chief observes that LTH has been paying out far more than it has made in profits in recent years, in the form of ‘dividends’ and ‘bonuses’, which has caused the fund to eat further into its capital reserves.

“Based on BNM monitoring, the practice of distributing dividends and bonuses to savers on average is higher than current profits. On average it was 107% in 2012–14, which has eaten into the reserves. The reserves were already low and they continue to go down to the point there are no longer enough to overcome the poor performance of the equity markets, particularly in 2015… this means at the current market rates LTH doesn’t have the assets to fulfil all its obligations…” [translation]

Breaking the law!

In the light of this critical situation the Governor goes on to complain that there is a sorry lack of adequate experience and expertise on the fund’s Board of Directors to tackle the problems, which she calls to be immediately rectified by appointing more competent new members.

Meanwhile, she points out that the conduct of the fund has put it in breach of the law.

Specifically she notes that LTH has violated Section 21 of the Lembaga Tabung Haji Act of 1995, which stipulates that its reserves must match its liabilities and also Section 22 of the Act, which says that it must not issue bonuses that exceed its profits.

—

Tabung Haji Insolvent – Zeti Warns PM That Fund’s Mismanagement … – http://asasian.net/tabung-haji-insolvent-zeti-warns-pm-that-funds-mismanagement-threatens-a-billion-ringgit-bail-out-exclusive/ … #asasian #news

—

Malaysia News @Malaysia_Latest 1 minute ago

malaysiakini: Did Bank Negara warn TabungHaji on its negative reserves? https://www.malaysiakini.com/news/328232 BNM_official

…

Malaysian Insider

Sack Tabung Haji chairman if claims of reserve shortfall true, says PAS

The Tabung Haji chairman, Datuk Abdul Azeez Abdul Rahim, should be sacked if reports that its reserves are in the negative are true and that is unable to pay dividends to its 8.8 million depositors, says PAS today.

The Islamist party’s deputy president Datuk Tuan Ibrahim Tuan Man said a new man should be brought in to ensure the pilgrims’ fund fulfilled its obligation to depositors in line with Bank Negara’s requirements.

However, the fund’s chief executive officer and group managing director is Tan Sri Ismee Ismail and its investments are overseen by an internal investment panel. While Azeez oversees the board, operations are run by Ismee.

In a strongly worded statement today, Tuan Ibrahim urged Prime Minister Datuk Seri Najib Razak, Minister in the Prime Minister’s Department Datuk Seri Jamil Khir Baharom, Azeez and Bank Negara governor Tan Sri Zeti Akhtar Aziz to clear the air over the fund’s financial affairs.

Tuan Ibrahim asked if it was true that the central bank had written to Jamil Khir about Tabung Haji’s financial position in 2015, where its reserves were in the negative.

He also asked if it was true that Bank Negara mentioned in the same letter that under the Tabung Haji Act 1955, the fund could not announce dividend and bonus payouts if its asset value was lower than its obligations.

“Is it also true that Bank Negara, in another letter to the Tabung Haji chairman, urged the pilgrims’ fund to come up with a comprehensive policy on its reserves before March 31?

“And if all these are true, is this the cause of the delay in Tabung Haji declaring dividend and bonus?” Tuan Ibrahim asked.

—

Tabung Haji reserves in the red, warns Bank Negara

…

Tabung Haji’s reserve levels are in the negative and it will not be able to pay its 8.8 million depositors any dividends this year if it does not take steps to resolve this, says Bank Negara Malaysia.

In a letter dated December 23, sighted by The Malaysian Insider, Bank Negara governor Tan Sri Zeti Akhtar Aziz told the pilgrims’ fund chairman Datuk Abdul Azeez Abdul Rahim that it has only 98 sen in assets for each ringgit in liability.

Section 22 of the Tabung Haji Act states that it cannot announce dividends and bonuses to its contributors if its assets are worth less than its obligations.

In a separate letter to Minister in the Prime Minister’s Department Datuk Seri Jamil Khir Baharom on the same date, also sighted by The Malaysian Insider, Zeti warned that Tabung Haji’s finances could have a financial impact on the government.

This was because Tabung Haji’s deposits were wholly guaranteed by the government, said Zeti.

She told Jamil that Tabung Haji’s role of aiding Muslims performing their haj might also be affected.

In her letter to Azeez, Zeti said Tabung Haji may have to liquidate its assets within a short time span to fulfil its obligations to depositors.

She said this would greatly reduce the value of its assets, and put the stability of the country’s financial and economic system at a higher risk through a “contagion effect”.

This was because it would affect other financial institutions and investors exposed to the assets, place liquidity pressure on banking institutions because of withdrawal of deposits by Tabung Haji, and have a negative effect on investor sentiments, Zeti said.

She blamed the depleting reserves on Tabung Haji’s practice of paying out higher dividends than it could afford since 2012.

“The dividend and bonus payout ratio which has, on average, exceeded its profits (on an average of 107% from 2012-2014) caused Tabung Haji’s already low reserves to decline further, to the extent that it is not able to manage the weak equity portfolio performance for 2015.

…

—

Assalammualaikum,

Pihak kami ingin menyaran kepada semua umat Islam di negara ini dan juga para pendeposit TH ini agar tidak membuat spekulasi berkaitan dengan tarikh pengumuman Bonus Pendeposit TH.

Pada kelazimannya TH akan mengumumkan Bonus Pendeposit pada suku pertama (Jan – Mac ) tahun semasa. TH perlu memastikan semua proses auditan awalan dilalui dan kelulusan dalaman diperolehi.

… See More

We like to party menyaran to all Muslims in this country and also the pendeposit th this so don’t make speculations associated with bonus announcement date pendeposit th.

On th kelazimannya pendeposit will announce bonus on first tribe (Jan – March) the current year. Need to make sure all th process initial auditan travelled and internal approval obtained.

The concept of money in th is alwadiah yad dhamanah where are what the return is in the form of grants financial achievement tertakluk to current year and favor talk to management.

The concept is no difference with the concept of alwadiah Islamic banking institution by the others.

In years past year th ever announce bonus pendeposit at end of February and early March. But in the last year can bonus announcement was announced earlier.

Although 2015 years is a challenge but th trust assets allocation strategy results can help return profits. By that so the pendeposit should not take the feature will be triggered anxiety.

Parts of public affairs and communications outreach group tabung haji

—

25 January 2016

No problem paying depositors’ dividends this year, says Tabung Haji

…

Lembaga Tabung Haji (TH) chairman Datuk Seri Abdul Azeez Abdul Rahim today slammed critics who accused the pilgrims fund of facing problems in paying out its 2015 dividends this year, saying it has until March to do so.

Insisting that TH has no issue paying out dividends to its nearly nine million contributors this year, he said an announcement on the matter would be made soon.

Azeez was responding to Amanah vice-president Datuk Dr Mujahid Yusof Rawa’s statement this morning urging the pilgrims fund to explain whether it could afford to pay dividends this year.

“Tell him (Mujahid), we will announce it shortly, don’t worry.

“Tabung Haji has no problem (paying the dividend). As usual, we have until March (to announce it). You can look at our previous records,” he told The Malaysian Insider.

…

He also called depositors not to speculate on the date when they would be receiving their bonuses.

He said the fund would usually make the announcement in the year’s first quarter, between January and March.

Azeez added that they needed to complete all initial auditing processes and obtain internal approval before moving forward with the payment.

He said there was nothing unusual as TH had previously announced the contributors’ bonuses at the end of February or in early March.

“However, last year the announcement was made earlier,” he said, adding that depositors should not be concerned about speculation.

—

Rizal Zulkapli AWANI

Rizal Zulkapli AWANI

asasian.net

asasian.net