—

Swiss Leaks (or SwissLeaks) is the name of a journalistic investigation of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse)

http://en.wikipedia.org/wiki/Swiss_Leaks

—

Swiss prosecutor raids HSBC premises, opens criminal inquiry | http://iexp.in/Cpl142889 #SwissLeaks

Geneva’s public prosecutor searched the premises of HSBC Holdings PLC in Geneva on Wednesday and said it had opened a criminal inquiry into allegations of aggravated money laundering.

…

HSBC, Europe’s biggest bank, apologised to customers and investors on Sunday for past practices at its Swiss private bank following allegations that it helped hundreds of clients dodge taxes.

…

The bank has said compliance and controls at its Swiss private bank in the period up to 2007 fell short of requirements. But it said the business had been transformed in recent years, adding that many people alleged to have been customers had long since left and that some were never clients.

…

The raid by the Swiss prosecutor comes more than a week after an investigation conducted by Washington-based International Consortium of Investigative Journalists, of which Indian Express is a member, revealed a trove of secret documents from HSBC’s Swiss private banking arm. The list, known as Swiss Leaks, contains names of HSBC account holders and their balances for the year 2006-07. They come from over 200 countries, the total balance over $100 billion.

—

Campaign to show that no one is TOO BIG to jail.

Time for tax justice

HSBC bank has just been caught red-handed helping some of the world’s mega-rich dodge taxes! We’d go to prison for this, but governments are treating these powerful people like they’re too big to jail. Let’s show them they’re not.

Our governments are losing $3 trillion a year to tax dodging — enough to end extreme world poverty many times over! This leak is the biggest in banking history — if we don’t seize it now to get prosecutions, we may never get a chance like this again.

UK finance minister Osborne faces an imminent election, while US Attorney General Lynch is yet to be confirmed in her new job. They’re both very sensitive to the public right now, so our million-strong call, delivered via ads and with legislators, could get them to investigate, prosecute, and send the tax-dodging elite a powerful signal: no one is too big to jail!

To UK Chancellor George Osborne, US Attorney General nominee Loretta Lynch, finance ministers and prosecutors:

Evidence published all over the world shows how HSBC helped criminals and the super rich hide their money and evade taxes, leaving the rest of us to pay for public services. We demand that you investigate and prosecute the bankers who facilitated tax dodging and their clients who enriched themselves at our expense, and tighten our tax laws to stop this happening again.

Click on this link for the petition:

https://secure.avaaz.org/en/hsbc_tax_dodge_loc/?twi

—

There are legitimate uses for Swiss bank accounts and trusts. We do not intend to suggest or imply that any persons, companies or other entities included in the ICIJ Swiss Leaks interactive application have broken the law or otherwise acted improperly. If you find an error in the database please get in touch with us.

—

COUNTRY RANKING

Australia (ranked #46)

Singapore (ranked #50)

Malaysia (ranked #87)

—

Beginning in 2012, the bank implemented a policy of closing accounts when it believes clients haven’t complied with tax laws, he said. The Swiss bank has reduced its client base by 65 percent since 2007.

CNBC

HSBC issues public apology amid tax avoidance allegations

HSBC has ‘no appetite’ to help clients avoid taxes, Chief Executive Stuart Gulliver says

The Associated Press Posted: Feb 15, 2015 10:31 AM ET

HSBC, Britain’s largest bank, issued a public apology Sunday, describing the media firestorm that followed allegations it helped rich clients dodge taxes as painful and insisting it has changed the way it does business.

Chief Executive Stuart Gulliver signed an ad published in several newspapers, arguing the controversy relates to “historical” practices that don’t reflect the bank’s current standards. HSBC has “no appetite” to help clients avoid taxes, he said.

“We must show we understand that the societies we serve expect more from us,” Gulliver said. “We therefore offer our sincerest apologies.”

HSBC has been at the centre of intense political debate in Britain since media reported that its Swiss private banking arm “aggressively marketed” tax avoidance schemes to the wealthy. The opposition Labour Party has criticized the government for failing to prosecute tax dodgers at the same time it is cutting benefits for the poor.

The reports were based on documents, most from 2005-2007, leaked by a former HSBC employee who gave the data to French tax authorities in 2008. France shared the information with other governments, who launched their own investigations.

http://linkis.com/www.cbc.ca/news/busi/sCHpo

…

Malay Mail Online

HSBC apologises over tax evasion claims with full-page letter in British papers

LONDON, Feb 15 — HSBC apologised to customers and investors today for past practices at its Swiss private bank after allegations that it helped hundreds of clients to dodge taxes.

Europe’s largest bank said in full-page advertisements in British newspapers that recent media coverage that focused on the Swiss operation and financial affairs of some of its clients had been a painful experience and that standards in place today “were not universally in place” in the past.

“We therefore offer our sincerest apologies,” the advertisement said. It is addressed to customers, shareholders and colleagues and is signed by Chief Executive Stuart Gulliver.

Most of the message echoes an email sent to staff on Friday, when Gulliver said that the bank had sometimes failed to live up to the standards expected of it.

HSBC has admitted failings in compliance and controls in its Swiss private bank after the media allegations that it may have enabled clients to conceal millions of dollars of assets, though Gulliver said that many people alleged to have been customers had long since left and some never were clients.

—

Australia (ranked #46)

Australia is ranked #46 among the countries with the largest dollar amounts in the leaked Swiss files.

The maximum amount of money associated with a client connected to Australia was $143M.

How much is this for Australia?

Australia’s GDP per capita was $41K in 2007. (Source: World Bank)

—

HOUSEWIVES?

According to ICIJ, the profession of “housewife” popped up “with amazing frequency” to describe a wealthy married woman, but also in some cases industry pioneers, architects, journalists, teachers, princesses and heiresses.

Among those named “housewives” by HSBC were advertising pioneer Mary Wells Lawrence, Saudi princess and education advocate Lolowah al-Faisal Al Saud, Thai entrepreneur Khunying Patcharee Wongpaitoon, and fashion house heiress Arlette Ricci.

“Sultanah Kalsom, listed by HSBC as a ‘housewife’, was connected to a numbered client account under the name “3678TE” from September 1994 to November 1997,” said a report by the International Consortium of Investigative Journalism (ICIJ).

—

ICIJ

Women listed as “housewives” by HSBC aren’t always what they’d seem.

…

The Real ‘Housewives’ of HSBC

It was just a day in the life of a housewife.

Hanne Tox, a Danish woman then 57 years old, stopped by HSBC Private Bank (Suisse) in 2005, to discuss her account.

It seemed a little complicated. A bank employee noted, “Acct holder living in Denmark, i.e. critical as it is a criminal act having an acct abroad non declared. … issue could be solved by … alternatives such as creating an Off-shore company.”

Months later, Tox visited her bankers again. This time, Tox spent the night in Zurich at one of the world’s most luxurious and historic hotels. “Opened in 1844 by Johannes Baur,” the hotel’s website notes, the property hosted the world premiere of the first act of Richard Wagner’s “Die Walküre” and “Baroness Bertha von Suttner convinced…the Swedish industrialist Alfred Nobel of the necessity for an international peace prize.”

Read more:

http://www.icij.org/project/swiss-leaks/real-housewives-hsbc

—

Singapore (ranked #50)

246 client accounts opened between 1972 and 2006 and linked to 571 bank accounts.

255 clients are associated with Singapore. 12% have a Singaporean passport or nationality.

Singapore is ranked #50 among the countries with the largest dollar amounts in the leaked Swiss files. See full ranking >>

The maximum amount of money associated with a client connected to Singapore was $194.2M.

How much is this for Singapore?

Singapore’s GDP per capita was $39.2K in 2007. (Source: World Bank)

Malaysia (ranked #87)

77 client accounts opened between 1982 and 2006 and linked to 201 bank accounts.

93 clients are associated with Malaysia. 28% have a Malaysian passport or nationality.

Malaysia is ranked #87 among the countries with the largest dollar amounts in the leaked Swiss files. See full ranking >>

The maximum amount of money associated with a client connected to Malaysia was $67.7M.

How much is this for Malaysia?

Malaysia’s GDP per capita was $7.2K in 2007. The top 10% held 34.76% of income in 2007. (Source: World Bank)

—

-

#SwissLeaks: how they hid the money

International Consortium of Journalists

Swiss Leaks: Murky Cash Sheltered by Bank Secrecy

KEY FINDINGS

- HSBC Private Bank (Suisse) continued to offer services to clients who had been unfavorably named by the United Nations, in court documents and in the media as connected to arms trafficking, blood diamonds and bribery.

- HSBC served those close to discredited regimes such as that of former Egyptian president Hosni Mubarak, former Tunisian president Ben Ali and current Syrian ruler Bashar al-Assad.

- Clients who held HSBC bank accounts in Switzerland include former and current politicians from Britain, Russia, Ukraine, Georgia, Kenya, Romania, India, Liechtenstein, Mexico, Lebanon, Tunisia, the Democratic Republic of the Congo, Zimbabwe, Rwanda, Paraguay, Djibouti, Senegal, Philippines and Algeria.

- The bank repeatedly reassured clients that it would not disclose details of accounts to national authorities, even if evidence suggested that the accounts were undeclared to tax authorities in the client’s home country. Bank employees also discussed with clients a range of measures that would ultimately allow clients to avoid paying taxes in their home countries. This included holding accounts in the name of offshore companies to avoid the European Savings Directive, a 2005 Europe-wide rule aimed at tackling tax evasion through the exchange of bank information.

http://www.icij.org/project/swiss-leaks

—

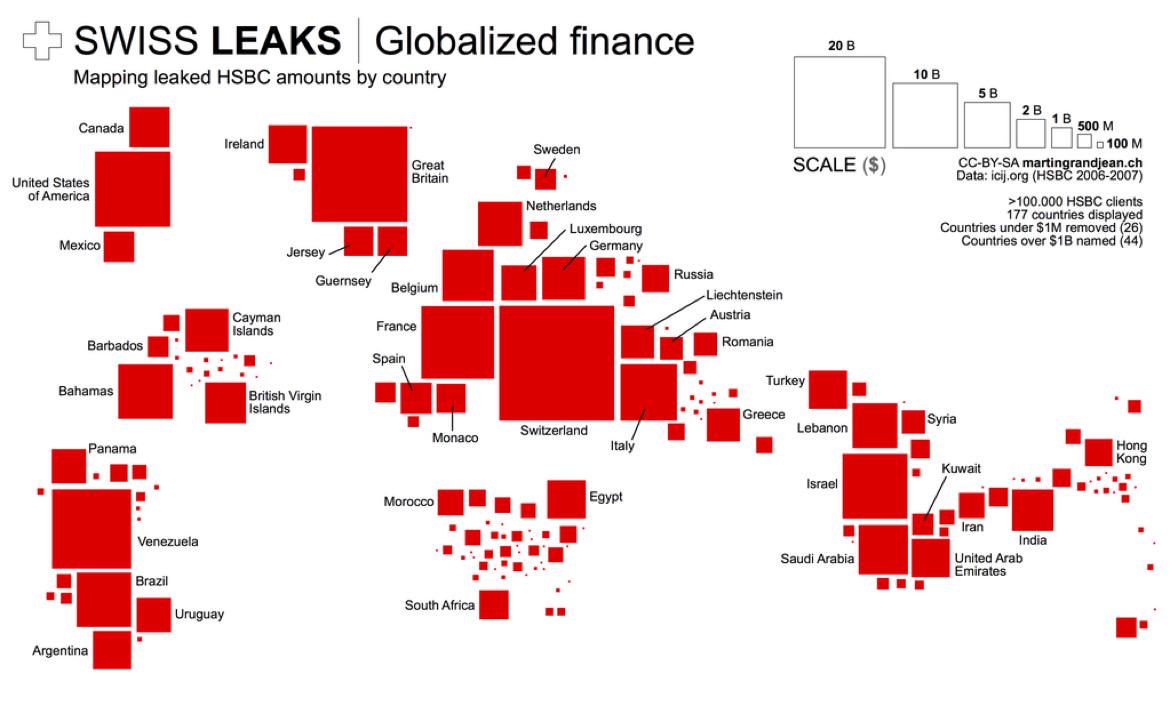

Want to visualise where the evasion identified in #SwissLeaks was occurring – check out this map h/t @GrandjeanMartin

How the #hsbc #swissleaks are seen in India

In SwissLeaks, Malaysia ranked No. 87 in dollars stashed in HSBC

Secret Swiss banking files leaked a week ago show Malaysia is ranked 87 among the countries with the largest dollar amounts in the international financial centre, with approximately US$174.3 million in 2007.

The data taken from global banking group HSBC also showed that the maximum amount of money associated with a client linked to Malaysia was US$67.7 million.

There were 201 bank accounts associated with 93 clients connected to Malaysia, according to the files, which have been dubbed SwissLeaks.

The country with the most client and dollar amount is Switzerland, according to The International Consortium of Investigative Journalists (ICIJ) website which posted details of the leaked files.

The leaked HSBC files – which were published by the Guardian newspaper and other media outlets last Sunday, and cover the period from 2005 to 2007 – shed light on some 30,000 accounts holding almost US$120 billion of assets.

The Guardian said the files revealed that HSBC’s Swiss bankers aggressively marketed a device that would allow its clients to avoid a new tax. They also showed that the bank hid money for suspected criminals, it added.

The ICIJ had only named 63 people with accounts in the Swiss arm of HSBC, the world’s second-largest bank. The only Malaysian named is Sultanah Kalsom, the consort of Pahang’s Sultan Ahmad Shah.

It added that she did not respond to repeated queries from the ICIJ.

To add perspective to the amounts held in the Swiss bank accounts, the website noted that Malaysia’s gross domestic product per capita in 2007 was US$7,200 while the World Bank 2007 statistics showed that the top 10% in Malaysia held 34.76% of the income then.

It also revealed that 77 client accounts were opened between 1982 and 2006 and linked to the 201 bank accounts in HSBC. Of the 93 clients associated with Malaysia, 28% have a Malaysian passport or nationality.

Malay Mail Online

Malaysian VIPs among those named in HSBC leaks, report shows

…

KUALA LUMPUR, Feb 15 — Several Malaysian public figures, including the Sultanah Kalsom of Pahang, were among listed as having an account with the Swiss branch of multinational bank HSBC, after a major leak revealed a clientele consisting of politicians, celebrities, criminals, traffickers and tax dodgers.

According to the leak now dubbed, “Swiss Leaks”, Malaysia was ranked 87th among 203 countries with the most amount of US dollars in the HSBC Swiss account, at US$173.4 million (RM621.6 million).

“Sultanah Kalsom, listed by HSBC as a ‘housewife’, was connected to a numbered client account under the name “3678TE” from September 1994 to November 1997,” said a report by the International Consortium of Investigative Journalism (ICIJ).

“The leaked files do not specify the exact role that she had in relation to the account,” it added.

ICIJ also pointed out that the Sultanah did not respond to its repeated request for comments.

According to ICIJ, the profession of “housewife” popped up “with amazing frequency” to describe a wealthy married woman, but also in some cases industry pioneers, architects, journalists, teachers, princesses and heiresses.

Among those named “housewives” by HSBC were advertising pioneer Mary Wells Lawrence, Saudi princess and education advocate Lolowah al-Faisal Al Saud, Thai entrepreneur Khunying Patcharee Wongpaitoon, and fashion house heiress Arlette Ricci.

Sultanah Kalsom is the second wife of Sultan Ahmad Shah, after marrying the Pahang ruler in 1992.

ICIJ said that Sultanah Kalsom is involved in charitable activities across Malaysia, including combating domestic violence and promoting childhood development and female empowerment.

————————————————————————————————————-

The Indian Express

The Indian Express

Maiol Sanaüja

Maiol Sanaüja