—

IS 1MDB TOXIC?

—

The “Sack 1MDB” video: Someone’s in trouble!

Tabung Haji, 1MDB and the Tun Razak Exchange (TRX) land deal.

—

…

…1Malaysia Development Berhad is a strategic development company, wholly owned by the Government of Malaysia.

It was established to drive strategic initiatives for long-term economic development for the country by forging global partnerships and promoting foreign direct investment.

1MDB began as Terengganu Investment Authority (TIA), a sovereign wealth fund aimed at ensuring economic development for the state of Terengganu that is long term and sustainable while safeguarding the economic well-being of the people of Terengganu.

TIA was established in 2008, and was renamed 1Malaysia Development Berhad on January 2009.

In his announcement on July 22, 2009, Prime Minister Najib Razak said the decision to expand TIA into a federal entity was made to enable its benefits to reach a broad spectrum of Malaysians rather than to the residents of only one state.

—

“Arul had lied before. It is not inconceivable that on the RM42 billion, Arul may be lying again.”

Jun 9, 2015

I can’t accept 1MDB numbers from a liar: Dr M

1MDB president and executive director Arul Kanda may have given a summary on where the company spent its RM41.8 billion but former premier Dr Mahathir Mohamad is unconvinced.

This, he said, is because Arul Kanda has on various occasions been caught lying and therefore cannot inspire confidence.

“I am intrigued by the ability of 1MDB to invest RM42 billion in so many businesses.

Really I should be fully satisfied with how 1MDB expended the huge loan that it borrowed. But unfortunately I am not.

I am not, because the information came from the current executive director, Arul Kanda and Arul has been caught lying quite a number of times,” he said in a blog posting today.

In particular, Mahathir took issue with Arul’s explanation over 1MDB’s US$1.103 billion (RM4.1 billion) investment in the Cayman Islands which the later claimed have been fully redeemed and later parked in Singapore.

“He (Arul) must have told the prime minister about this fantastic pile of dollar notes so the prime minister answered the question in Parliament that the cash is in a bank in Singapore.

“It cannot be brought back because Bank Negara asks too many questions. The finance minister must approve or disapprove all Bank Negara strictures or approvals.

Then the Singapore bank denied that the cash was in its bank (in Singapore). Embarrassing. The vision has disappeared.

“No. It is not cash. It is documents. No, it is units. What units? Dunno (sic). Which bank? Not clear. The mystery deepens,” Mahathir in sarcastic full form.

http://www.malaysiakini.com/news/301235

—

—

8 June 2015

Board of troubled 1MDB set to step down http://www.malaysiakini.com/news/301052 | https://twibble.io

10:20AM Jun 8, 2015

The board of directors at Malaysia’s state fund 1Malaysia Development Bhd (1MDB) will be made to step down as early as July, The Edge Financial Daily reported today, citing unidentified sources.

Dogged by years of controversy over the US$11.6 billion in debt it has amassed to finance the purchase of power assets as well as alleged mismanagement of its funds, 1MDB last week became the subject of an enquiry by Malaysia’s central bank.

1MDB’s six-member board of directors is led by chairperson Lodin Wok Kamaruddin and CEO Arul Kanda.

The Edge did not make clear who or what entity would be ordering the board to step down.

The daily also quoted one unidentified source as saying that 1MDB’s advisory board, which is chaired by Malaysia Prime Minister Najib Abdul Razak, could also step down.

A 1MDB spokesperson declined to comment on the report.

http://www.malaysiakini.com/news/301052

—

#1MDB CEO: Here’s how we used RM42b… http://bit.ly/1QoOoxY

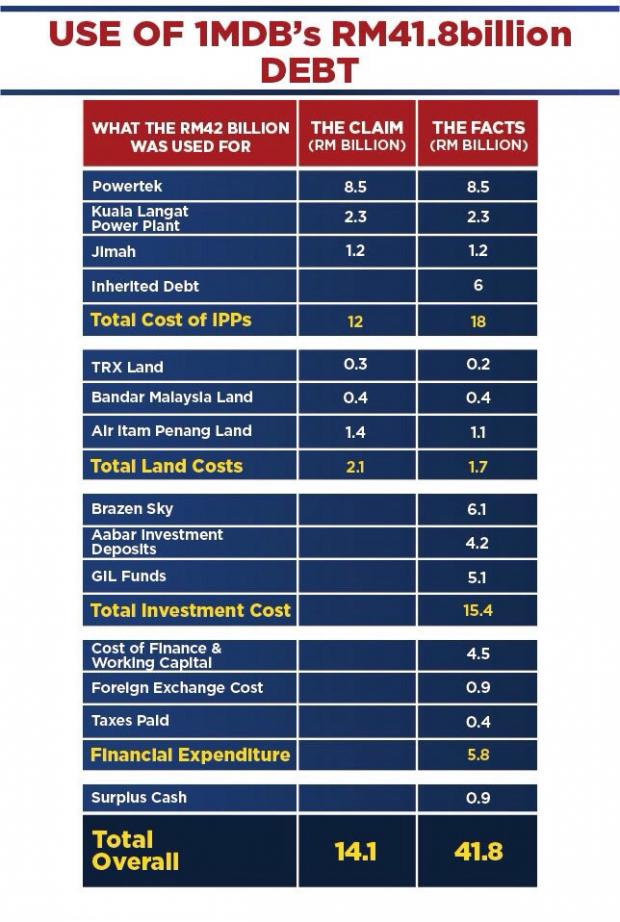

KUALA LUMPUR, June 3 — In a bid to silence all speculation over where and how 1 Malaysia Development Berhad (1MDB) allegedly squandered nearly RM42 billion, the firm’s chief executive Arul Kanda Kandasamy provided today a detailed breakdown of what the money was used for.

In a brief statement accompanying a graphical presentation of the breakdown, Arul Kanda pointed out that every single ringgit in the RM41.8 billion it used has been accounted for.

“In recent weeks, there has been much speculation about the use of RM42 billion of debt raised by 1MDB, and more specifically that RM27 billion of debt proceeds are alleged to be ‘lost’ or ‘missing’,” he said, referring to allegations raised previously by former prime minister Tun Dr Mahathir Mohamad.

“We provide a summary of what the RM42 billion debt has been used for, information that is fully disclosed in 1MDB’s audited and publicly available accounts from 31 March 2010 to 31 March 2014.

“We trust this clarification will help to clear any confusion on this matter,” Arul Kanda said.

—

Star

Thursday June 4, 2015 MYT 6:39:18 AM

Summary raises questions over spending

PETALING JAYA: Controversial 1Malaysia Development Bhd (1MDB) has given a brief summary of how it has incurred a RM41.8bil debt bill in a space of five years.

While the explanation showed where the money raised has gone to, it did not debunk criticism on why a sum of RM15.4bil raised locally and some of it guaranteed by the Government, are placed with funds outside the country for purposes of investments and as security deposit for loans.

It also reveals a staggering RM4.5bil that 1MDB has incurred in financing and capital cost and RM900mil in foreign exchange cost, which accountants describe as a sizeable amount that needs to be explained further.

…

However, an accountant said the cost of financing and working capital incurred by 1MDB to acquire the assets and run its operations at RM4.5bil was on the high side.

“It raised debts to acquire power plants and three parcels of land. The other amounts raised were largely placed with fund managers as investments or as security deposits. Investments placed with fund managers should give returns and not incur financing cost.

“Similarly, the deposits should also give returns and not incur financing cost,” said the accountant.

The accountant pointed out that stripping out the investments placed with the funds outside Malaysia and the debt of RM6bil inherited when acquiring the power plants, the actual cash outlay 1MDB incurred in acquiring the power plants and three parcels of land was RM13.7bil.

“In acquiring assets of RM13.7bil, it incurred RM5.4bil in cost of financing, working capital and foreign exchange cost between 2010 and 2014.

“That needs further explanation. Without a breakdown in how much was the finance cost and working capital it is difficult to say whether the funds were well utilised,” said the accountant.

—

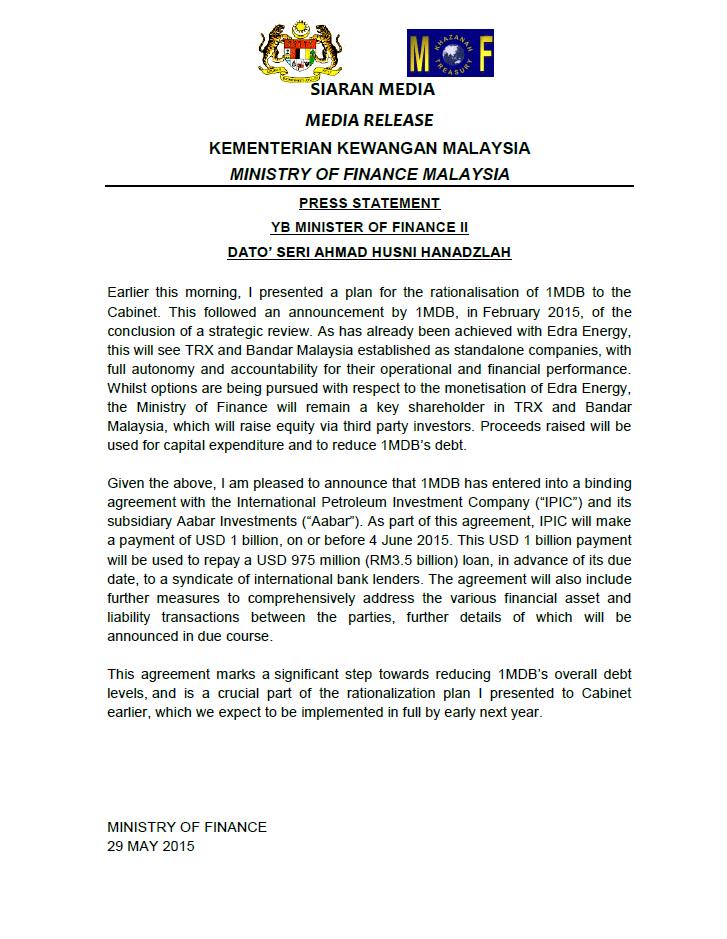

4:00PM May 29, 2015

Dubai white knight gallops to 1MDB’s rescue

Angel investor, International Petroleum Investment Company (IPIC) comes to #1MDB rescue http://www.malaysiakini.com/news/300072

UAE’s International Petroleum Investment Company (IPIC) will pay 1MDB’s US$975 million (RM3.57 billion) debt to an international banking consortium which is demanding payment four months ahead of schedule.

This was announced by Second Finance Minister Ahmad Husni Hanadzlah, who submitted a proposal to cabinet today on the restructuring plan for 1MDB.

“I am pleased to announce that 1MDB has entered into a binding agreement with the IPIC and its subsidiary Aabar Investments PJS (Aabar).

“As part of this agreement, IPIC will make a payment of US$1 billion, on or before June 4, 2015.

“This US$1 billion payment will be used to repay a US$975 million loan, in advance of its due date, to a syndicate of international bank lenders.

“The agreement will also include further measures to comprehensively address the various financial asset and liability transactions between the parties, further details of which will be announced in due course,” he said in a statement today.

http://www.malaysiakini.com/news/300072

—

Malaysian Insider

Tony Pua files complaint with accounting body against Deloitte

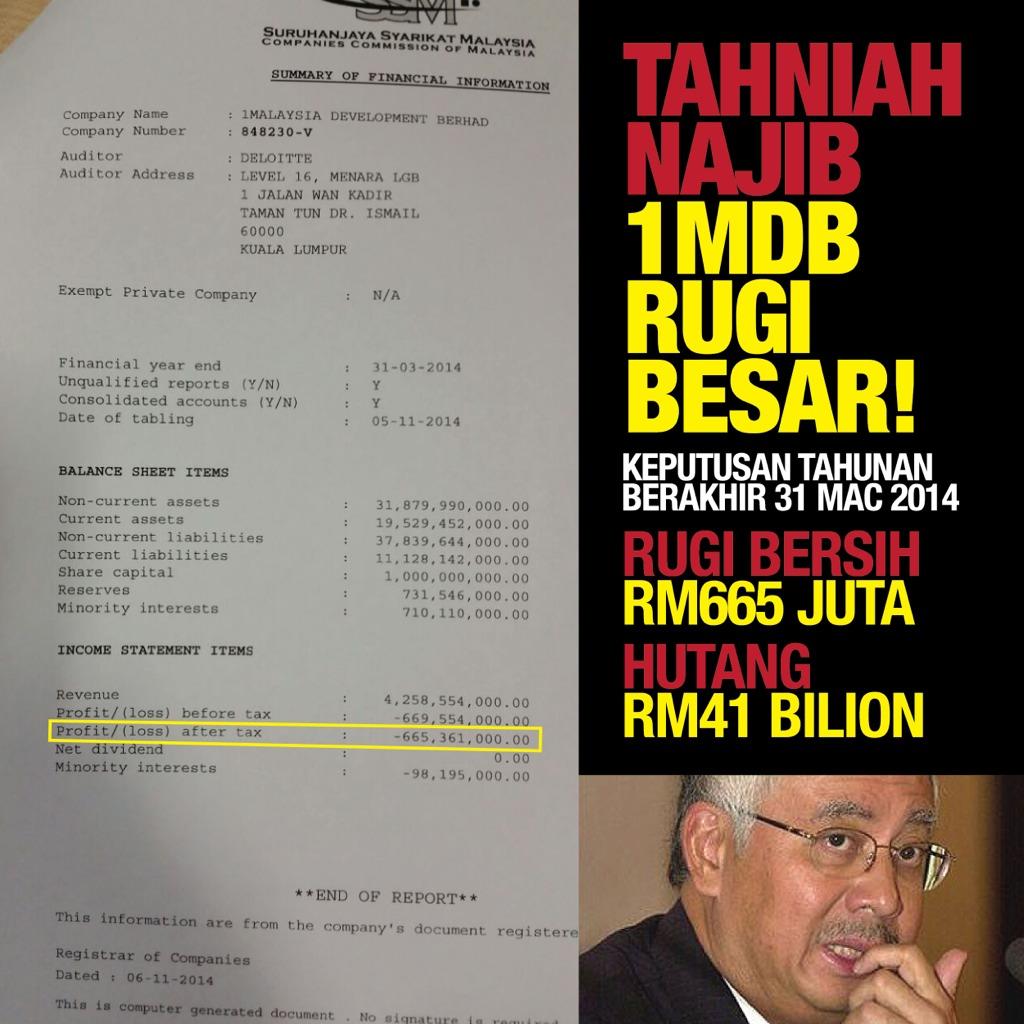

A DAP lawmaker today filed a complaint against international auditor Deloitte and its audit partner Ng Yee Hong for failing to conduct a thorough audit on debt-ridden 1Malaysia Development Berhad (1MDB).

Petaling Jaya Utara MP Tony Pua said the complaint lodged at the Malaysia Institute of Accountants was over the audit of 1MDB for March 2013 and 2014.

“Among the reasons I decided to proceed with an official complaint against Deloitte is because both the prime minister and board of directors of 1MDB have been using Deloitte as a shield to defend and justify the state of 1MDB today,” he said at the Malaysian Institute of Accountants (MIA) office in Kuala Lumpur this afternoon.

Pua said Deloitte Malaysia intentionally or negligently failed to conduct sufficient and necessary due diligence and audit of the cash flow and liquidity risk of 1MDB.

“Deloitte signed off and endorsed 1MDB as a going concern on November 5, 2014 despite the company facing an imminent liquidity crisis, as exposed before the end of the month when it was unable to repay its RM2 billion debt.”

“So something must have been wrong. They didn’t do their audit properly.”

– See more at: http://www.themalaysianinsider.com/malaysia/article/tony-pua-files-complaint-with-accounting-body-against-deloitte#sthash.EMcENAmM.dpuf

—

Malaysian Insider

1MDB’s audited assets stands at RM51 billion, says Najib

The total worth of 1Malaysia Development Bhd (1MDB) audited assets for the financial year-ended March 31, 2014 was RM51.4 billion, the Dewan Rakyat was told today.

The assets comprised current assets worth RM19.5 billion and non-current assets valued at RM31.9 billion, according to a written reply from the finance minister, Datuk Seri Najib Razak, to a question from Wong Chen (PKR-Kelana Jaya).

It said 1MDB has solid assets, including two sites earmarked for the Tun Razak Exchange and Bandar Malaysia in the capital.

Other assets include a 94.69ha in Penang, 13 power plants, and desalination (facilities) in five countries.

“The value of the 1MDB assets is supported by its valuation or book value, which was confirmed by an independent auditor (Deloitte),” according to the reply.

—

#FLASH Najib’s brother calls #1MDB no-show ‘unacceptable’ http://www.malaysiakini.com/news/299629 .@NajibRazak .@1MDB

Prominent #Malaysia banker Nazir Razak slams 1MDB board on Instagram http://bit.ly/1AqoHLE

The CIMB group chairman posted on Instagram Tuesday the front page of a financial news daily slamming 1MDB’s president and group executive director Arul Kanda Kandasamy as well as its former CEO Datuk Shahrol Azral Ibrahim Halmi for not being able to attend an inquiry by the Public Accounts Committee (PAC) inquiry.

Nazir posted the picture together with the comment: “Your company has triggered a national crisis and you can be too busy to face Parliament? Unacceptable.”

—

Will 1MDB spread its ‘cancerous cells’ to Tenaga Nasional?

Star

Tenaga skids to mid-December low on worries of high price for Edra assets

KUALA LUMPUR: Tenaga Nasional’s share price extended its losses and fell to the lowest since mid-December 2014 on worries it might have to pay more for 1Malaysia Development Bhd’s (1MDB) power assets.

At midday, the power giant’s share price had fallen 48 sen to RM13.22 – the lowest since Dec 17 — and erased 4.63 points from the FBM KLCI. Year-to-date, the share price is down 58 sen or 0.42%.

UOB Kay Hian Malaysia Research said the fall in Tenaga’s share price could have been affected by talk that the power company might have to pay lofty prices for 1MDB’s power assets.

…

“We estimate Edra’s assets are worth RM11.6bil, based on current replacement market value (our assumptions: gas-fired power plant replacement cost of RM2.3bil, coal-fired power plant replacement cost of RM6.7bil).

“Given the wide pricing discrepancy of almost 40%, we believe the deal may face a stumbling block in the near term,” it said.

—

http://www.thestar.com.my/Business/Business-News/2015/05/23/1MDBs-cash-crunch/?style=biz

…

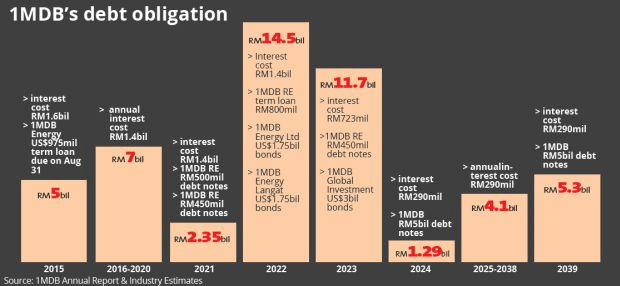

1MDB’s cash crunch http://fw.to/QGBvX9C next nine years are crucial for fund

The next nine years are crucial for fund, as its obligations are estimated at some RM40bil

THE recipe for the downfall of any company is taking on short-term debt to fulfil long-term projects. This is what symptomises 1Malaysia Development Bhd’s (1MDB) ills, which needs some RM40bil in the next nine years to meet its debt obligations.

The increasing limelight that the fund has come under – not only from politicians but also from the man in the street – does not help its case either.

The tipping point for 1MDB to be a topic of discussion among the kampung folk is Lembaga Tabung Haji’s (LTH) purchase of a parcel of land in the Tun Razak Exchange (TRX) that is to be developed by 1MDB for RM188.5mil.

…

1MDB has cashflow problems, something that even Second Finance Minister Datuk Seri Ahmad Husni Hanadzlah has admitted to. This has raised questions on the company’s ability to meet its debt obligations of RM42bil.

…

This year, 1MDB has obligations of RM5bil to meet, and the bulk of it is in the form of a US-dollar term loan amounting to US$975mil (RM3.5bil) that matures on Aug 31.

“But we have to bear in mind that some of the debt can be refinanced if 1MDB’s credit standing improves,” says a banker.

Nevertheless, the next nine years will be crucial for 1MDB. Adding on to the burden is that the bulk of the liabilities are in US dollar-denominated bonds and notes. Based on the notes in the latest annual report, 1MDB has been using money raised for development projects to meet its debt obligations, including the servicing of interest.

http://www.thestar.com.my/Business/Business-News/2015/05/23/1MDBs-cash-crunch/?style=biz

—

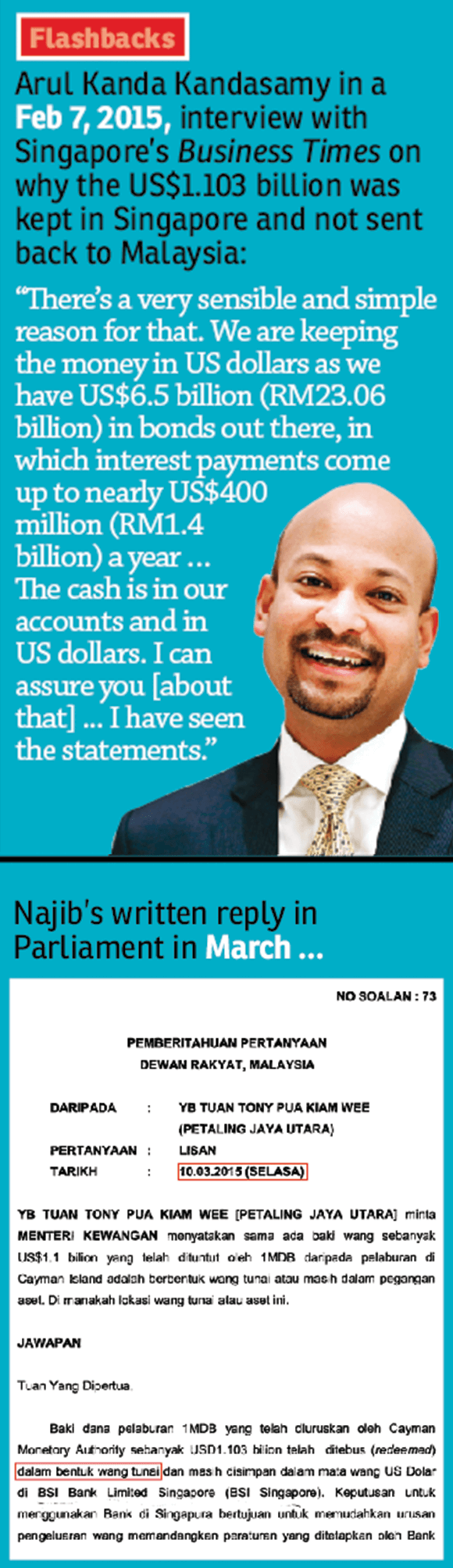

JUST WHAT IS THE TRUTH?

10 March 2015

Najib, in a written reply to DAP MP Tony Pua at Parliament, “The remaining US$1.103 billion (RM4.08 billion) of 1MDB’s investment funds managed by the Cayman Monetary Authority has been redeemed in cash and is kept in US currency by the BSI Bank Limited Singapore (BSI Singapore).”

19 May 2015

Najib to Tony Pua: The balance of the investment redeemed by 1MDB were assets in US dollars for the purpose of balancing its liabilities which were also in US dollars. This latest answer was an “amendment” to the earlier one.

7 February 2015

1MDB president Arul Kanda Kandasamy, said that the cash was in the state investment vehicle’s account in BSI, in US dollars. “I can assure you … I have seen the statements,” he was quoted as saying in an interview with Singapore’s Business Times.

21 May 2015

Second Finance Minister, Datuk Seri Ahmad Husni Mohamad Hanadzlah said that only “units” existed in the BSI Bank Limited Singapore account.They are units, backed by sovereign wealth funds.

—

Malaysian Insider

Cash, assets or units? Malaysians react online after conflicting statements on 1MDB

Malaysians are calling for heads to roll after Putrajaya yesterday admitted that 1Malaysia Development Bhd’s (1MDB) investments redeemed from the Cayman Islands to Singapore were not actually in cash as previously claimed.

Social media users vented their frustration on Facebook and Twitter, calling the government “liar” and demanded that those responsible for the gaffe step down immediately.

“It wasn’t a mistake. The finance minister actually lied to us abt 1MDB’s cash in Singapore,” said Umar Akif through his Twitter handle @JustAkifff.

Benedict Tan said on Facebook: “It’s not a mistake… it’s a deliberate lie and all involve should be sacked and actions be taken on them.”

“So the hard cash was not there at all in Singapore bank kan…? So you lied kan…? #1MDB,” added @taxi_driver21.

—

If I were a rich man I’d buy #1MDB “goldmine”, Malaysia PM @NajibRazak says http://tdy.sg/1JOV0DC

KLANG — Prime Minister Najib Razak denied today (May 16) claims that a large portion of some RM42 billion in debt accumulated by 1 Malaysia Development Berhad (1MDB) is unaccounted for, saying it is locked in with the value of two major development projects spearheaded by the state-owned fund.

He said the latent value of prime land in the Tun Razak Exchange and the planned Bandar Malaysia in Sungai Besi sufficiently accounts for the figure being touted by naysayers as having gone “missing”.

“They say RM42 billion disappeared… It did not disappear. Look at the Tun Razak Exchange, there are 70 acres. Bandar Malaysia has 500 acres,” he said in his speech at a gathering with Selangor Umno members and supporters here.

“This is a goldmine. If I were a rich man, I would buy there because I know its value after 20 years,” he added. MALAY MAIL ONLINE

http://www.todayonline.com/world/asia/najib-if-i-were-rich-man-id-buy-1mdb-goldmine

—

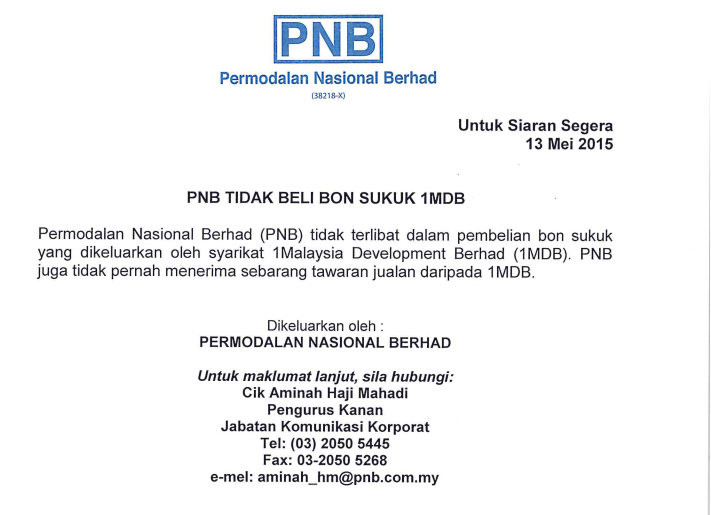

Wednesday May 13, 2015 MYT 2:53:15 PM

PNB denies buying sukuk bonds from 1MDB: http://bit.ly/1KHOMpc

PETALING JAYA: Permodalan Nasional Berhad (PNB) has denied claims that it has bought sukuk bonds from the debt-ridden 1Malaysia Development Berhad (1MDB).

In a brief statement issued Wednesday, PNB also said it has not received any offers from the Government investment arm.

“PNB is not involved in the purchase of sukuk bonds issued by 1MDB. PNB was also never offered any bonds from the company,” said the country’s leading asset managers.

On Tuesday, PKR vice-president Rafizi Ramli said both PNB and Lembaga Tabung Haji bought the Islamic bonds from 1MDB worth RM1.5bil, based on a report in The Star last year.

“Since Tabung Haji had admitted that it bought RM920.8mil worth of sukuk from 1MDB, this can only mean PNB had bought the remaining RM579.2mil,” he reportedly said.

http://www.thestar.com.my/News/Nation/2015/05/13/PNB-denies-buying-sukuk-1MDB/

—

10:00PM May 11, 2015

‘TH’s RM920.8 mil in 1MDB bond secure’

Lembaga Tabung Haji (TH) today clarified that it invested in the Bandar Malaysia Sukuk Issuance in February 2014, as it is a secured investment.

The sukuk is effectively secured against parcels of land in Bandar Malaysia with security cover of at least 1.67 times, said its Chief Investment Officer Abd Kadir Sahlan in a statement today.

…

At the end of the investment periods, TH will receive total proceeds of RM1.55 billion resulting in a RM626.5 million profit, said Abd Kadir.

– Bernama

http://www.malaysiakini.com/news/298016?hootPostID=73e993fd94c7f3cd22a2251548881d2a

—

Even before the dust from the TRX land deal has settled, here comes a new ‘shocker’!

Free Malaysia Today

PAS hits Tabung Haji with RM1.6bn sukuk shock

KUALA LUMPUR: With the dust barely settling from the aborted Tabung Haji land deal, PAS vice-president Tuan Ibrahim Tuan Man has opened the question of whether the pilgrims fund faces exposure to RM1.6bn in risk from an Islamic bond investment.

Tuan Ibrahim, referring to leaked documents published by an anonymous blog, said it appeared that Tabung Haji had made an investment in sukuk bonds issued by the Bandar Malaysia property project of the troubled government company 1Malaysia Development Bhd.

The risk element amounted to RM1.6 billion, he said in a statement, and wanted to know: “Does this mean Tabung Haji had invested a total of RM1.6 billion in 1MDB before the controversial purchase of land from 1MDB?”

He said the document showed that 1MDB had announced its sale of RM2.4 billion in Bandar Malaysia sukuk bonds in February last year.

Tuan Ibrahim asked if that meant Tabung Haji had funded 66% of the sukuk bond issue.

“What is the status of the sukuk investment? Has it generated returns or has it been used to pay off 1MDB’s mounting debts?” Tuan Ibrahim said.

—

Malay Mail Online German banks seek early repayment of 1MDB loan, could trigger default on RM42b debt

.

.

.

.

—

Free Malaysia Today

Ex-MB drops 1MDB bombshell on his sacking

Ex-Terengganu MB Ahmad Said discovered hanky panky from the beginning at 1MDB prior to being dropped as MB.

KUALA TERENGGANU: Kijal Assemblyman Ahmad Said dropped a bombshell in the Assembly on Tuesday when he said, during his speech on the Sultan’s address, that he was forced out as Menteri Besar after he found that there was hanky panky at the 1Malaysia Development Berhad (1MDB) from the beginning.

The proverbial straw that broke the camel’s back was a 1MDB plan to mortgage the oil and gas resources of Terengganu.

“At that time, 1MDB was known as the Terengganu Investment Authority (TIA),” clarified Ahmad. “Eventually, the plan to mortgage the oil and gas resources was dropped.” One result, he recalled in breaking his silence on the issue, was that he was forced out as Menteri Besar.

“TIA quit Terengganu to become 1MDB but we got back our money invested in the Agency.

Malaysian Parliament’s Public Accounts Committee begins probe on #1MDB http://tdy.sg/1HbMwch

…

…

…

—

Sarawak Report

12 Feb 2015

Computers And Servers All WIPED At 1MDB

Concerned staff at 1MDB have confided that all computers and records at the troubled fund were recently called in and wiped. They say this includes not only personal computers belonging to staff but also the mainframe servers as well! The order came as a surprise move by management, according to sources and it happened just before Christmas. Staff were contacted directly by phone or in person and told to take their computers immediately to the IT section in order to be wiped. None of the instructions were delivered by text or email, leaving little record of the blitz, which took place in the space of just a few hours. The result is that there are few records left available to show what has been going on at the beleaguered fund and this is widely believed amongst staff to be the reason.

The excuse was they had ‘been hacked’

The excuse given to bewildered staff members was that there had been a systems hack. One of them sent out this message on the day it happened, which was Friday 19th of December, a fortnight before the departure of the previous CEO Mohd Hazem Abdul Rahman:

“1MDB has been collecting employee laptops and company-issued handphones today. Staff were contacted in person or by phone call and informed to hand them in to IT. No emails or text messages were sent. On asking the reason for the hand-in staff were advised that there has been a hacking attempt and that therefore the company is collecting all laptops and handphones in order to wipe them (wipe the discs clean) before they are returned. Parallel to that the main servers are being wiped. If you try to email a 1MDB employee now the email will bounce back as undeliverable. Obviously the reason given is incredulous to say the least”

Experts have told Sarawak report that the excuse of a hacking attempt is indeed rarely a credible reason for wiping information from servers:

It makes absolutely no sense to wipe servers to protect against hacking or online attacks. Instead you would either take these severs offline altogether until the issue was resolved or step up security. When Sony was hacked recently they didn’t wipe all their servers.

This snap decision to expunge all past records and emails from all staff computers and handheld devices as well as the organisations mainframe computers will inevitably raise questions about whether management were trying to conceal potentially embarrassing information before the handover. For more: http://www.sarawakreport.org/2015/02/computers-and-servers-all-wiped-at-1mdb/ — YAHOO! NEWS SINGAPORE

1MDB repays RM2 billion loan after Ananda Krishnan bailout, say sources

Malaysia’s debt-heavy strategic investor 1Malaysia Development Bhd (1MDB) settled a RM2 billion loan yesterday with money from billionaire T. Ananda Krishnan, six days before bankers triggered a default, say sources.

The Malaysian Insider understands from bankers familiar with the matter that the banks involved received the money yesterday evening, hours after Ananda was said to have agreed to the bailout.

The payment is a last-minute reprieve for 1MDB – a cross between a sovereign fund and a private investment firm wholly owned by the Ministry of Finance. Its debt woes were seen as pressuring the ringgit and Malaysia’s sovereign credit rating.

“The money has come in. It was an Ananda bailout,” said a source familiar with the matter.

Other sources confirmed the repayment of the RM2 billion for tranche 2 of the RM5.5 billion bridging loan to the relevant banks.

The 1MDB subsidiary, Powertek Investment Holdings Sdn Bhd, took the loan last May to refinance a RM6.17 billion bridging loan taken in 2012 to part finance the purchase of power assets.

1MDB restructured the RM5.5 billion bridging loan into two tranches: a RM3.5 billion loan due by August 2024 and a RM2 billion loan due last November, according to data from LPC, a Thomson Reuters unit specialising in loans.

The RM2 billion loan was guaranteed by Ananda’s company Usaha Tegas, said people with knowledge of the talks between Ananda and 1MDB. Malaysia’s Maybank has 58.99% of the RM2 billion loan while RHB has 32.41%. The other lenders are Alliance Investment Bank Bhd (4.06%), Malaysia Building Society Bhd (3.24%) and Hwang DBS Investment Bhd (1.29%). https://sg.news.yahoo.com/1mdb-repays-rm2-billion-loan-ananda-krishnan-bailout-230024338.html — According to sources, the 1MDB executives were told in very strong terms that they will face action if the matter is not settled. Sources said the inability of 1MDB to meet its payments shows how it is struggling with cash flow that cannot support its debt servicing. However, newly appointed president and group executive director of 1Malaysia Development Berhad (1MDB), Arul Kanda Kandasamy has had to come out in defence of 1MDB over its inability to service its debts. Malaysian Insider

Bank Negara grills top executives as 1MDB fails to settle RM2 billion debt again

Published: 6 January 2015 Not only is heavily indebted 1Malaysia Development Bhd (1MDB) getting a new chief executive officer (CEO), but it has also failed for a second time to pay a RM2 billion loan to local lenders due on December 31 last year. Sources said 1MDB has now been given until January 30 to settle the debt that was originally due on November 30, 2014. Malayan Banking Bhd (Maybank) and RHB Bank Bhd are the lead lenders. The problem has been brought to the attention of Bank Negara Malaysia (BNM), and sources said at a recent meeting, top executives from 1MDB led by chairman Tan Sri Lodin Wok Kamaruddin, director Tan Sri Ismee Ismail and outgoing CEO Mohd Hazem Abdul Rahman were given a dressing-down by the central bank. … The RM2 billion is part of the RM5.5 billion debt taken through its subsidiary Powertek Investment Holdings Sdn Bhd last May to refinance a RM6.17 billion bridging loan taken in 2012 to part finance the purchase of power assets. The remaining RM3.5 billion has been converted into a 10-year term loan due in August 2024. Maybank has 58.99% of the RM2 billion loan while RHB has 32.41%. The other lenders are Alliance Investment Bank Bhd (4.06%), Malaysia Building Society Bhd (3.24%) and Hwang DBS Investment Bhd (1.29%). http://www.themalaysianinsider.com/malaysia/article/bank-negara-grills-top-executives-as-1mdb-fails-to-settle-rm2-billion-debt?utm_medium=twitter&utm_source=twitterfeed … Malaysian Insider

1MDB responsible borrower and never defaulted, says new chief

The cover story in The Edge Financial Daily today with the report on 1MDB’s inability to repay its debts. – The Malaysian Insider pic, January 6, 2015.

The cover story in The Edge Financial Daily today with the report on 1MDB’s inability to repay its debts. – The Malaysian Insider pic, January 6, 2015.Just a day after being appointed president and group executive director of 1Malaysia Development Berhad (1MDB), Arul Kanda Kandasamy has had to come out in defence of the strategic investor over its inability to service its debts. “As far as the banking sector and the credit sector is concerned, we are responsible borrowers and the company has never defaulted,” Arul Kanda Kandasamy told Bloomberg today. “We need to manage the use of our cash in the most efficient way for the company,” he added. http://www.themalaysianinsider.com/malaysia/article/1mdb-responsible-borrowers-says-new-chief-denying-default-report —

1MDB’s CEO steps down as $4bil IPO looms

1MDB’s CEO steps down as $4bil IPO looms http://shar.es/1HASmJ

http://business.asiaone.com/news/1mdbs-ceo-steps-down-4bil-ipo-looms —

Overwhelming crowds at the 1MDB forum by the NOW & C4! Govt mismanagement of public funds cannot be tolerated anymore

…

Malaysian Government, 1MDB lending money to Petrosaudi, for them to pay us back the interest.

..

..

Full House beb! #1MDB

—

Report details 1MDB’s power plant power purchase terms: http://bit.ly/1ugQbxL

Based on the deals it had entered into with the Usaha Tegas group and International Petroleum Investment Company PJSC (IPIC), 1MDB’s entry cost is estimated to be as high as RM4.29bil for the purchase of the Powertek and Genting power plants, which eventually led to it getting three other power plant projects in the country. The cost comprises the goodwill incurred, the cost to buy out IPIC’s options, the cost to buy out the option from Usaha Tegas should it not convert its warrants to equity in 1MDB’s power division listing, and the fees paid to Goldman Sachs to raise US-dollar debt papers tied to the purchase of the two power plants in 2012. This does not include the opportunity cost of putting an estimated RM4bil in as deposit that was held as collateral for the IPIC guarantee. http://www.thestar.com.my/Business/Business-News/2014/11/11/Expensive-foray-Latest-annual-report-details-1MDBs-terms-with-IPIC-and-Usaha-Tegas-for-purchase-of-p/?style=biz —

Our latest story is now online – How 1MDB’s ‘Development’ Money Paid Tony Blair RM218,000pm!… http://fb.me/3MyvfreTw

1MDB Funded RM218,000 Per Month Retainer To Tony Blair!

London’s Sunday Times newspaper has published a front page story revealing that the former UK Prime Minister Tony Blair was hired by PetroSaudi International for RM218,000 ($65,000) a month, plus a 2% ‘success fee’ on transactions. The controversial company was itself funded by a billion plus dollar loan from the Malaysian Development Fund 1MDB and has provided no other evidence of substantial income for that period. It works out at an annual ‘retainer’ of over RM2.6million for the ex- British PM, all apparently funded by Malaysian development money. There has been considerable criticism that Blair has been combining his role as a Middle East negotiator with involvement in private oil deals. This new Sunday Times report provides devastating new evidence what it dubs his “cash-for-contacts” business.  .. Sarawak Report can confirm that the contract between Tony Blair Associates and PetroSaudi International (both based in London) was negotiated in 2010, not long after the shadowy oil exploration company had received a total of US$1.7billion dollars from Malaysia’s supposed ‘development fund’ 1MDB. However, the company told the Sunday Times that the arrangement in fact ended after a few months. For the full article: http://www.sarawakreport.org/2014/11/how-1mdbs-development-money-paid-tony-blair-rm218000pm/ — 1MDB had total assets worth RM51.4bil as of the end of March this year and total liabilities stood at RM49bil. The fund made a loss of RM665.4mil for the year ended March 31, largely due to the burden of servicing the huge debts. http://www.thestar.com.my/Business/Business-News/2014/11/07/Daim-1MDB-should-not-keep-funds-overseas-The-board-must-explain-why-money-needs-to-be-put-in-Cayman/?style=biz —

.. Sarawak Report can confirm that the contract between Tony Blair Associates and PetroSaudi International (both based in London) was negotiated in 2010, not long after the shadowy oil exploration company had received a total of US$1.7billion dollars from Malaysia’s supposed ‘development fund’ 1MDB. However, the company told the Sunday Times that the arrangement in fact ended after a few months. For the full article: http://www.sarawakreport.org/2014/11/how-1mdbs-development-money-paid-tony-blair-rm218000pm/ — 1MDB had total assets worth RM51.4bil as of the end of March this year and total liabilities stood at RM49bil. The fund made a loss of RM665.4mil for the year ended March 31, largely due to the burden of servicing the huge debts. http://www.thestar.com.my/Business/Business-News/2014/11/07/Daim-1MDB-should-not-keep-funds-overseas-The-board-must-explain-why-money-needs-to-be-put-in-Cayman/?style=biz —

Infografik hutang #1MDB ini yg saya post di FB 10jam lalu tlh dilihat 900k orang. Siapa kata rakyat Msia tidak kisah

—

Daim: I don’t think 1MDB has been unfairly criticised http://fw.to/4g4Z77W

Daim: 1MDB should not keep funds overseas

1MDB posted RM669.5 million in pre-tax losses in FY14 from RM4.26 billion in revenue compared to pre-tax profits… http://fb.me/MZP4PoZ9

1MDB’s paper gains from property revaluation were not enough to offset higher costs and expenses, but 1MDB says the losses were expected given its strategy to grow its assets base. —

Rafizi vows damning revelation on 1MDB: PKR MP to reveal names of those involved in Cayman Islan… http://bit.ly/1vTKYsm

PKR lawmaker Rafizi Ramli has promised to reveal the people and companies involved in state-owned 1MBD’s funds in Cayman Islands. “I will be revealing them in Parliament next Monday at 11.30am,” he said in a statement. The Pandan MP said he is working with a team from the National Oversight & Whistleblowers (Now) on this matter. Rafizi, who played an instrumental role in exposing the National Feedlot Corporation imbroglio, added that he has a copy of the loan agreement, which he would also expose. The agreement, he claimed, clearly showed that the federal government is a guarantor for all of 1MDB’s debts. “This clearly contradicts (deputy finance minister) Ahmad Maslan’s statement that Putrajaya is not guarantor for 1MDB’s RM41 billion debts. “The Najib Abdul Razak administration is merely hiding behind technicalities. We have to ensure that those responsible will be taken to task for 1MDB’s wrongdoings,” he said. Rafizi said he would also push for Ahmad, who is the Pontian MP, to answer to a special parliamentary committee for “lying” to parliament if the deputy minister does not rectify his previous statement. http://www.malaysiakini.com/news/279859?utm_source=twitterfeed&utm_medium=twitter — Star

Friday November 7, 2014 MYT 7:19:18 AM

1MDB pulls out of Caymans

PARLIAMENT: At The DEWAN RAKYAT 1MALAYSIA Development Bhd’s (1MDB) RM7.18bil in offshore accounts in the Cayman Islands is expected to be channelled back to the country by December. “Sixty per cent of the money is already back. The remaining 40% will be brought back by the end of this year,” Deputy Finance Minister Datuk Ahmad Maslan said in his reply to Tony Pua (DAP-Petaling Jaya Utara) when winding up his ministry’s debates on Budget 2015. He said the repatriation would be done despite the profits of between 6% and 7% per annum from the investments. Later, when met at the Parliament lobby, Ahmad said the money was being brought back to fund 1MDB’s projects such as the Tun Razak Exchange and Bandar Malaysia development projects. He said this excluded the money used to finance the sovereign wealth fund’s power plant projects and loan servicing.

————————————————————————————————————

Roger Teoh

Roger Teoh  Muthanna Saari

Muthanna Saari

Pingback: Tabung Haji, 1MDB and the Tun Razak Exchange (TRX) land deal. | weehingthong

Pingback: The “Sack 1MDB” video: Someone’s in trouble! | weehingthong

Pingback: MAHATHIR MAHATHIR | weehingthong

Pingback: Malaysia: Trending Hashtags of 2015 | weehingthong